Updates

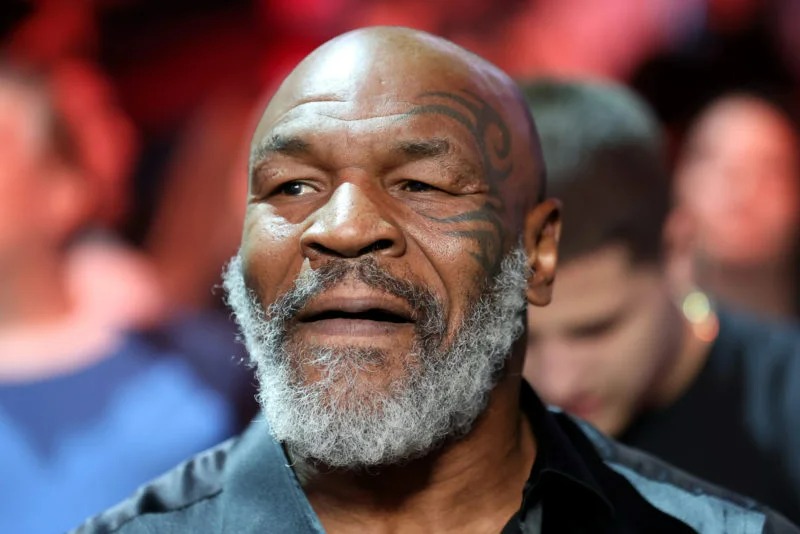

How Mike Tyson blew $300 million and went broke

Mike Tyson, a former heavyweight boxing champion, has opened up about his financial struggles and how he lost his multi-million dollar fortune.

In an episode of his podcast, Hotboxin’, Tyson revealed that he never kept any money in banks and wanted to spend every penny he earned as soon as he got it.

“I wanted it in my house just blow it all every second of it,” he said.

This mentality led to his downfall, as he had no one guiding him on how to grow his fortune.

During the 1980s, Tyson was making millions of dollars.

“A guy like me back then I was making 20-18 million dollars. So I am doing whatever I want and I don’t have, nobody got a chain on me and said hey Mike come back that’s a little bit too much,” he explained.

Despite people trying to advise him to save for the future, Tyson refused to listen and wanted to blow away all his wealth.

“They said that but I didn’t wanna hear that. I don’t wanna put my money in no damn bank. You crazy?”

Tyson accumulated a net worth of over $400 million by the end of his career, but he was forced to declare bankruptcy in 2003 and lost every penny of his fortune.

His uncontrolled spending was a major factor in his financial downfall.

He had several multi-million dollar mansions fully furnished with luxury items and a collection of super luxury cars.

He also owned three pet tigers that cost him millions of dollars to take care of.

In addition to his spending habits, Tyson also accused his manager at the time, Don King, of not paying him his fair share from fights.

He sued the promoter for $100 million for defrauding him of his earnings.

Despite his financial struggles, Tyson has since bounced back after his acting career took off.

He now runs a successful podcast and is also involved in various other businesses.

Tyson’s financial struggles were not unique to him, as many professional athletes have also faced similar issues.

The lack of financial literacy and guidance is a common problem among athletes who suddenly come into large sums of money.

According to a 2009 Sports Illustrated article, 78% of NFL players and 60% of NBA players are bankrupt or under financial stress within two years of retirement.

To address this issue, the NBA has implemented a financial education program for its players, which includes workshops and seminars on topics such as budgeting, investing, and taxes.

The NFL also has a similar program for its players.

These programs aim to educate athletes on how to manage their money and make informed financial decisions.

Tyson’s story serves as a cautionary tale for those who come into sudden wealth.

It highlights the importance of financial education and guidance, as well as the dangers of uncontrolled spending.

As Tyson himself has said, “It’s not what you make, it’s what you keep.”

Popular Posts:

MUST READ: