Updates

Jessica Alba’s Honest Co Valued at $2 Billion as it makes incredible stock market debut

Popular Posts:

MUST READ:

The Duke and Duchess of Sussex’s son, Archie, received a Specialized bike as a birthday gift...

Prince Harry and Meghan Markle have reportedly not received an invitation to attend the King’s Birthday...

Prince Harry has been on a self-destructive path this year. With his strained relationships with his...

A royal expert has claimed that Prince Harry is seen as a “loose cannon” by the...

Popular American comedian and podcaster, Tim Dillon, has branded Prince Harry and Meghan Markle as “low-grade...

The big-budget thriller Citadel, which is being streamed on Amazon Prime, has made a crude and...

The Trooping of the Colour, which has marked the British Sovereign’s official birthday for more than...

Prince Andrew, Duke of York, has reportedly refused to leave his home, the Royal Lodge, during...

Prince Harry and Meghan Markle, the Duke and Duchess of Sussex, recently made headlines when a...

A petition to abolish the Prince of Wales title in the United Kingdom is gaining momentum...

Prince Edward, the Earl of Wessex, has caught the attention of royal fans lately due to...

In Russia, the audience of Who Wants to be a Millionaire rarely “Asks the Audience” because...

Prince Harry has reportedly contacted divorce lawyers amid marriage problems with Meghan Markle, according to socialite...

Kate Middleton is reportedly relieved that she doesn’t have to fake a united front with Meghan...

Prince Harry’s American dream is reportedly falling apart due to his alleged marital issues with Meghan...

News just in: not good | Arwa Mahdawi It appears that America’s love affair with the...

Prince Harry has revealed that he considered Africa as his “lifeline” and the place where he...

Prince Harry, the Duke of Sussex, has been accused of having an over-inflated ego and thinking...

Actor Treat Williams, best known for his roles in “Hair” and “Everwood,” has died at 71...

Pop superstar Taylor Swift has cancelled her membership at the members-only club, Casa Cipriani in New...

Bruce Lee was an iconic figure in martial arts, renowned for his physical fitness and acting...

When it comes to casting for comic book movies, there are always going to be some...

Ben Affleck has had a successful career in Hollywood, having acted, written, and directed several critically...

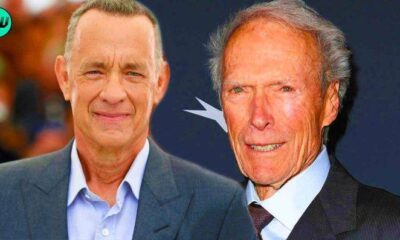

Tom Hanks’ talent as an actor is widely recognized, and he has worked with numerous famous...

Hong Kong actress Suet Fa recently voiced her opinion on the “scoundrels” of showbiz, accusing Jet...